[Recently], Gallup reported that the total number of new business startups and business closures per year, known as “the birth and death rates," [...] just crossed to the bad for the first time since [its] measurement began—[a]nnually, 400,000 new businesses are being born nationwide, while 470,000 are dying. [...] [Until] the recession, startups outpaced business … Continue reading Is the Recession Really Over?

Dropouts Are Putting a Major Strain on Our Economy

Despite all the efforts of every president from Kennedy to Obama, [high-school dropouts] are a blight on our society. According to DoSomething.org, [more than] 1.2 million students drop out of high school in the United States every year, [or roughly] 7,000 kids a day. [In 1970], the United States [...] had the world’s highest graduation … Continue reading Dropouts Are Putting a Major Strain on Our Economy

DollarDays Reinvents Wholesale Business with Dynamic New Website

Those familiar with DollarDays, the country's premier online wholesaler, will tell you its recent site redesign was long overdue. DollarDays had simply outgrown its website, limiting its ability to take the customers to the next level. In December 2013, DollarDays engaged Arizona agency Resound Creative to create a redesign strategy focused on user experience and … Continue reading DollarDays Reinvents Wholesale Business with Dynamic New Website

Who Pays for Our Kids’ Education?

CBS News reported there are 200 one-room public schools located in rural areas left in America. At one time, just about every child was taught in a one-room school. Our second president, John Adams, taught in a one-room school near Boston. Abraham Lincoln was educated at a one-room school. Henry Ford loved his one-room schoolhouse … Continue reading Who Pays for Our Kids’ Education?

Kids Lose Their Future to Poverty

Now that one school year is over and we are preparing for the next, June is a month of reflection for educators and parents on how to do better [for the] next school year. It is hard enough for students to learn at school in today’s world. You throw in overcrowding, teacher-to-student ratios, poverty affecting … Continue reading Kids Lose Their Future to Poverty

Do You Really Save Money by Buying Online?

Trying to save money shopping online can be exhausting. Entire industries have grown up online to help you save money, but you can spend so much time trying to figure out what to do that in the long run, it’s not even worth it to save a couple of dollars. So Many Options! For instance, … Continue reading Do You Really Save Money by Buying Online?

Why Fight for Our Country?

Earlier this year, Stars and Stripes, the independent newspaper to the military community, reported [that among] male veterans under [the age of] 30, [the suicide rate has increased by] 44%—[in other words, an average of] 22 veterans [...] take [his or her] own lives [every day]. Reasons for the increase could be the pressures of … Continue reading Why Fight for Our Country?

Helping Small Businesses—Lots of Talk, No Action

The Small Business Act of 1953 established the Small Business Administration (SBA), which came into existence on the grounds that small businesses are essential to a free enterprise system. It was the intent of establishing the SBA to “deter the formation of monopolies and the market failures monopolies cause by eliminating competition in the marketplace,” … Continue reading Helping Small Businesses—Lots of Talk, No Action

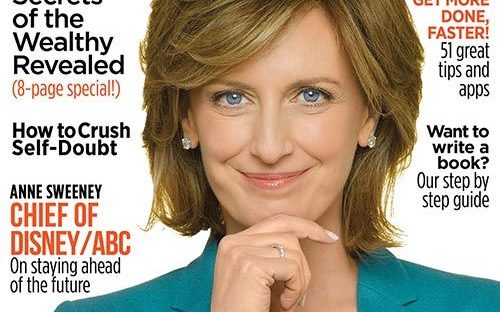

How to Publish a Book

Who hasn't dreamed of seeing their name on a book jacket at the local Barnes & Noble? Signing cover pages for lines of adoring fans? Watching your very own title climb the New York Times best-seller list? As any recent author will tell you, the arduous process of writing a book hardly resembles this glamorous picture. But … Continue reading How to Publish a Book

The War on Poverty is Back; This Time, It’s the People’s Burden

Feeding America reports that 15.9 million kids [in the United States] under the age of 18, [or one in five], are unable to consistently access nutritious and adequate amounts of food necessary for a healthy life. Last month, Congress passed a sweeping "Farm Bill" that cut an additional $8.6 billion from SNAP, [or the] Supplemental … Continue reading The War on Poverty is Back; This Time, It’s the People’s Burden